US-China Tariff War: Impact on Cryptocurrency and Stock Markets

An in-depth analysis of how escalating tensions are reshaping global financial landscapes

Table of Contents

- Introduction to the US-China Tariff War

- Recent Developments: Escalation to 145%

- Impact on Global Stock Markets

- Cryptocurrency Market Reaction

- Bitcoin Performance During Trade Tensions

- The Decoupling Phenomenon

- Implications for Bitcoin Mining

- Investor Strategies in Uncertain Times

- Future Outlook and Predictions

Introduction to the US-China Tariff War

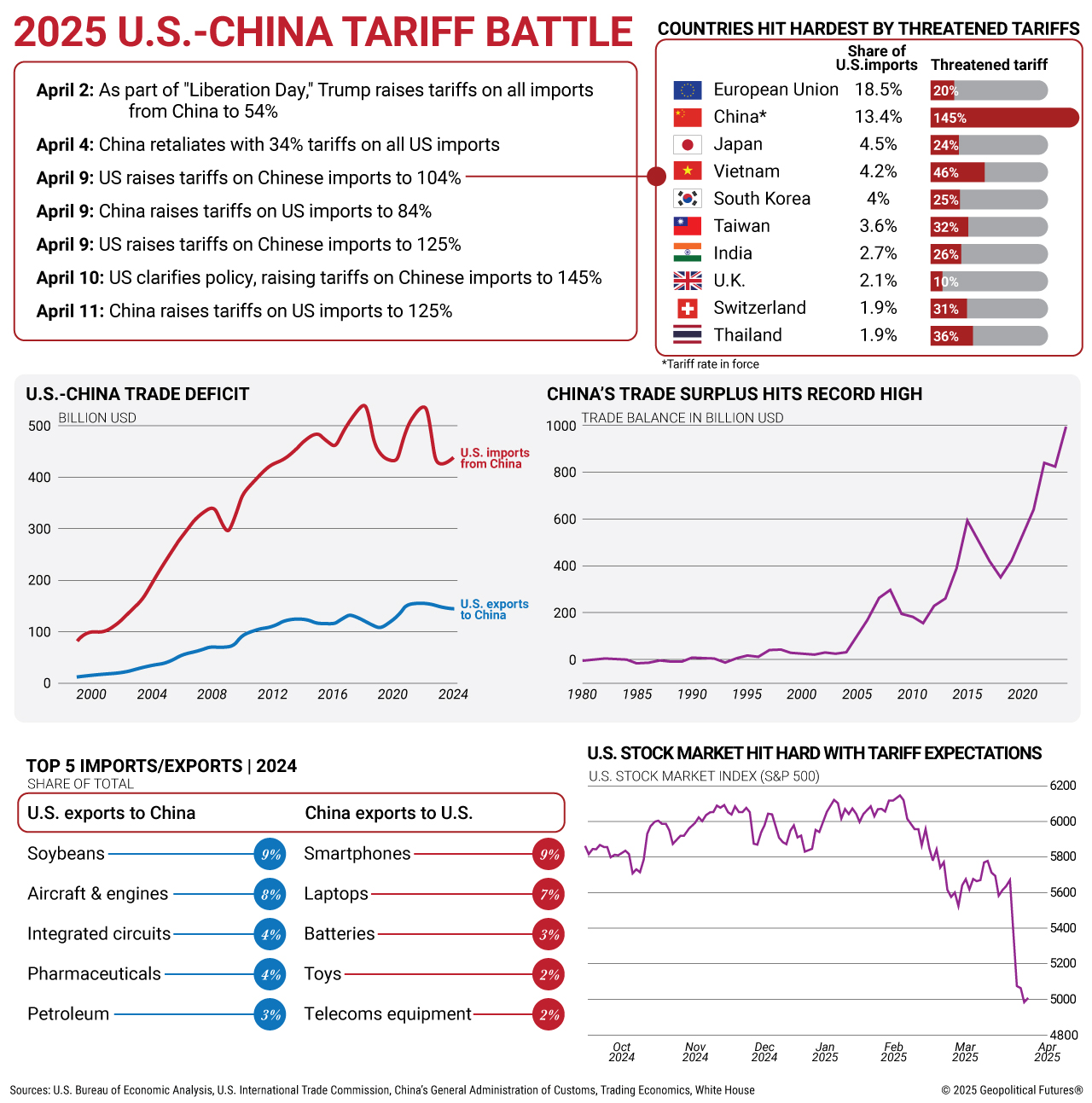

The economic conflict between the United States and China has intensified dramatically in 2025, with tariffs reaching unprecedented levels. What began during the first Trump administration has now evolved into a full-scale trade war with severe implications for global markets, including both traditional stock exchanges and cryptocurrency markets.

As the world's two largest economies engage in tit-for-tat trade measures, investors across all asset classes are scrambling to understand the implications and reposition their portfolios accordingly. The ripple effects have been felt from Wall Street to crypto exchanges, creating both challenges and opportunities.

"Tit-for-tat trade salvoes between the US and China have seen Washington raise import taxes on Chinese goods to 145 percent and Beijing retaliate with comparable measures, creating significant market turbulence." — Al Jazeera, April 2025

Visualization of the escalating tariff exchanges between the US and China. Source: Geopolitical Futures

Recent Developments: Escalation to 145%

CBC News: How China is fighting Trump's tariffs in 2025

The trade war has reached a critical inflection point in April 2025, with the Trump administration imposing a staggering 145% tariff on Chinese imports. In response, China has retaliated with its own 125% tariff on U.S. goods starting April 12, marking the highest level of trade barriers between the two nations in modern history.

Key Tariff Timeline (April 2025)

- April 2: Trump administration closes China and Hong Kong exemptions

- April 4: China imposes 34% retaliatory tariffs on US imports

- April 7: US raises tariffs to 104% on Chinese goods

- April 9: Trump announces 90-day pause on non-China tariffs, markets rally

- April 10: China raises tariffs to 84% on US imports

- April 11: Trump increases China tariffs to 145%

- April 12: China retaliates with 125% tariffs on US goods

The escalation has sent shockwaves through global markets, with the WTO chief warning that these measures could reduce trade in goods between the two economic giants by as much as 80%. Chinese officials have stated they will "never yield" to tariff pressures, setting the stage for a prolonged economic confrontation.

Impact on Global Stock Markets

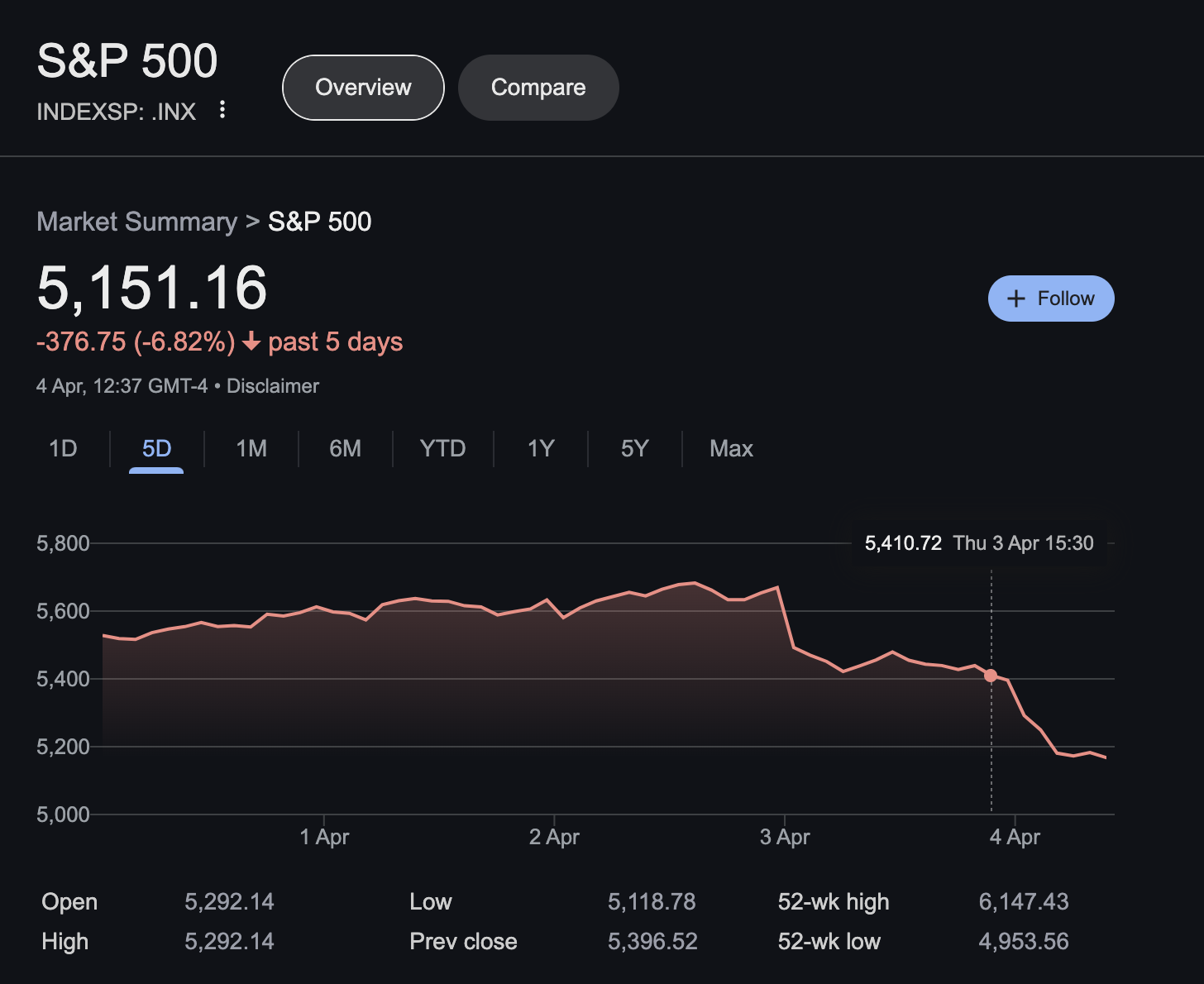

Market reaction to Trump's tariff announcements and pauses. Source: The Economist

Market Volatility and Sector Impact

The S&P 500 experienced one of its most volatile weeks since the COVID-19 pandemic, plunging into bear market territory before recovering slightly after the 90-day pause announcement on non-Chinese tariffs. Overall, U.S. equities have suffered substantial losses.

S&P 500 Losses Since Tariff Announcement

The technology sector has been particularly hard hit, with companies dependent on Chinese manufacturing or with significant Chinese market exposure seeing double-digit percentage drops in their stock prices. Retail giants like Amazon have also suffered as sellers warn of imminent price increases on consumer goods.

"The US stock market tumbled deeply into the red on Thursday as the White House clarified its plan for a massive 145% tariff on China, wiping out trillions in market value and raising fears of prolonged economic damage." — CNN, April 10, 2025

While U.S. and Chinese markets have borne the brunt of the impact, European and Asian markets have also experienced significant volatility. The interconnected nature of global supply chains means few economies remain unaffected by the escalating trade tensions.

Cryptocurrency Market Reaction

Unlike traditional markets, cryptocurrencies have shown surprising resilience during the latest round of tariff escalations. After initial price drops following Trump's first tariff announcements, major cryptocurrencies including Bitcoin stabilized and even recovered some losses while stock markets continued to decline.

This divergence has prompted renewed discussion about Bitcoin's potential as a safe-haven asset during geopolitical and economic uncertainty. While traditional safe havens like gold have also performed well during this period, Bitcoin's recovery pattern has caught the attention of institutional investors.

Key Cryptocurrency Market Indicators

Illustration of how trade wars are reshaping cryptocurrency markets. Source: Economic Times

"The mere threat of tariffs sent crypto prices spiraling precipitously in February, highlighting the sensitivity of the market to geopolitical events. However, the market has shown remarkable stability during the actual implementation phase in April." — AInvest, April 2025

Cryptocurrency analysts point to several factors explaining this resilience, including increased institutional adoption, improved market infrastructure, and crypto's growing perception as an alternative to fiat currencies during periods of economic stress.

Bitcoin Performance During Trade Tensions

Bitcoin price chart during the escalation of US-China trade tensions. Source: Economic Times

Bitcoin has experienced significant volatility but has maintained key support levels throughout the tariff escalation cycle. After dropping as low as $76,000 following China's initial retaliatory tariff announcement, Bitcoin rebounded and has held above the critical $81,000 level.

Bitcoin Key Price Levels

Technical analysts note that Bitcoin's ability to maintain these price levels despite the economic uncertainty suggests strong underlying demand. The cryptocurrency has managed to close above $82,000 each day of trading during the peak of tariff announcements, demonstrating resilience compared to traditional equities.

"Bitcoin's performance sparked debate about its status as a safe haven rather than a risk asset, with volatility lower than many major stock indices during the tariff crisis." — CoinDesk Weekly Recap, April 11, 2025

Derivatives data shows approximately $793.4 million worth of Bitcoin long positions clustered around the $81,100 level, creating strong incentives for investors to defend this price point and prevent further downswings.

The Decoupling Phenomenon

One of the most intriguing developments during the recent tariff war escalation has been the potential decoupling of cryptocurrency markets from traditional financial markets. While the S&P 500 plunged 6% in the immediate aftermath of the tariff announcements, Bitcoin and other major cryptocurrencies demonstrated significantly more stability.

This divergence represents a significant shift from previous market behavior, where cryptocurrencies often mirrored stock market movements during periods of economic stress. Analysts suggest this could indicate cryptocurrency's maturing status as an alternative asset class.

"If Bitcoin's resilience this week persists and decouples from the ongoing US stock crash, BTC could begin to attract hedge demand from investors seeking 'flight-to-safety' plays to mitigate trade war exposure risks." — FXStreet, April 4, 2025

S&P 500 Performance vs. Bitcoin during tariff announcements. Source: FXStreet/Nasdaq

The decoupling has been particularly noteworthy in DeFi (Decentralized Finance) markets, which saw increased activity even as traditional markets tumbled. According to data from CoinDesk, platforms like Aave experienced record-high deposits during the peak of market uncertainty, demonstrating increased trust in decentralized financial systems during geopolitical tensions.

Factors Contributing to Crypto Decoupling

- Increased Institutional Adoption: More sophisticated investors with longer-term horizons

- Geographic Diversification: Crypto markets operate globally with less dependence on US-China trade

- DeFi Growth: Decentralized finance providing alternative trading and investment options

- Inflation Hedge: Growing perception of Bitcoin as protection against economic instability

- Market Maturation: Improved market infrastructure and liquidity

Whether this decoupling represents a temporary anomaly or a fundamental shift in cryptocurrency's relationship with traditional markets remains a subject of intense debate among market analysts.

Implications for Bitcoin Mining

The US-China tariff war has created unexpected consequences for the Bitcoin mining industry, potentially reshaping the global distribution of mining power. With Chinese tariffs on US imports now at 125%, US-based mining companies face significantly higher costs for acquiring mining equipment (ASICs), most of which is manufactured in China.

This cost increase may inadvertently benefit the overall security and decentralization of the Bitcoin network by preventing excessive concentration of mining power in the United States.

"The increased Chinese tariffs on the U.S. will make it more costly for U.S.-based public Bitcoin mining companies to purchase ASICs (the premier machines used to mine bitcoin), the majority of which are produced in China. And this will be largely beneficial for the health of the Bitcoin mining ecosystem." — Bitcoin Magazine, April 2025

Cryptocurrency mining operations. Source: Reuters

Experts note that a more distributed global hashrate enhances Bitcoin's censorship resistance, which is one of its core value propositions. When mining power is excessively concentrated in one country, the network becomes more vulnerable to regulatory pressures and potential censorship.

Tariff Impact on Mining Distribution

- Higher Equipment Costs: US miners facing 125% price increases on Chinese-made ASICs

- Competitive Disadvantage: Non-US miners gaining cost advantages in equipment acquisition

- Hashrate Redistribution: Potential shift of mining power to regions outside US and China

- Enhanced Network Security: More distributed mining power improves censorship resistance

- Domestic Manufacturing Push: Potential catalyst for US-based ASIC manufacturing development

The situation highlights how geopolitical tensions can have unintended positive consequences for decentralized networks like Bitcoin, potentially strengthening their fundamental value proposition during periods of international conflict.

Investor Strategies in Uncertain Times

BBC News analysis: Understanding tariffs and trade war implications

As markets navigate the turbulent waters of the US-China tariff war, investors are adopting various strategies to protect their portfolios and potentially capitalize on emerging opportunities. Traditional safe-haven assets like gold have performed well, but cryptocurrencies are increasingly being considered as part of diversification strategies.

Traditional Market Strategies

- Defensive Sectors: Utilities, healthcare, consumer staples

- Reduced China Exposure: Limiting investments in companies with significant Chinese operations

- Alternative Markets: Shifting focus to markets less affected by US-China tensions

- Cash Positions: Increasing liquid assets to capitalize on potential buying opportunities

- Gold and Precious Metals: Traditional safe-haven assets

Cryptocurrency Strategies

- Bitcoin Accumulation: Buying during market dips below key support levels

- DeFi Participation: Utilizing decentralized finance platforms for yield generation

- Stablecoin Allocation: Maintaining portions in USD-pegged assets for stability

- Mining Stock Evaluation: Reassessing mining companies based on tariff impacts

- Cross-Chain Diversification: Spreading investments across multiple blockchain ecosystems

Financial advisors emphasize the importance of maintaining a long-term perspective during periods of geopolitical tension. Reactionary trading based on day-to-day tariff news has generally produced poor results, while strategic portfolio adjustments with a multi-year outlook have historically performed better.

"In the short term, higher U.S. tariffs could mean increased inflation and weaker economic growth, creating volatility in Bitcoin and risky assets. However, the medium-term impact could establish cryptocurrency as an alternative safe haven if traditional markets continue to struggle." — CoinShares, February 2025

Institutional investors have been particularly active during this period, with several major funds increasing their cryptocurrency allocations as a hedge against continued market volatility in traditional equity markets.

Future Outlook and Predictions

Projected GDP impact of US-China tariffs. Source: Visual Capitalist

Economic Projections

Economists project significant long-term consequences from the current tariff levels if maintained over an extended period. Yale University's Budget Lab estimates that the current tariffs could reduce U.S. real GDP growth by 1.1 percentage points, with particularly severe impacts on consumer goods like clothing and textiles.

Projected Economic Impact

For cryptocurrency markets, analysts present several potential scenarios based on how the trade tensions evolve:

Scenario 1: Prolonged Trade War

Tariffs remain at current levels for 12+ months, causing sustained economic damage

Crypto Impact:

- Increased adoption as inflation hedge

- Continued decoupling from stocks

- Mining power redistribution accelerates

- Bitcoin potentially reaching $100K+

Scenario 2: Negotiated Resolution

Trade deal reached within 3-6 months, tariffs reduced or eliminated

Crypto Impact:

- Initial volatility during negotiations

- Re-correlation with traditional markets

- More balanced mining distribution

- Bitcoin stabilizing at $75-85K range

Scenario 3: Economic Crisis

Tariffs trigger broader economic instability and potential recession

Crypto Impact:

- Initial correlation with market downturn

- Followed by potential safe-haven adoption

- Mining consolidation among strongest firms

- High volatility but long-term strengthening

The consensus among cryptocurrency analysts is that while short-term volatility is likely to continue, the long-term impact of the tariff war may ultimately strengthen Bitcoin's value proposition as an alternative to traditional financial systems.

"While the escalating tariff war may be incredibly anxiety-inducing on a number of levels, consider taking some solace in the fact that it may be good for Bitcoin by promoting more distributed mining power globally." — Bitcoin Magazine, April 2025

As both nations continue to escalate their trade measures, investors in both traditional and cryptocurrency markets should prepare for continued uncertainty while looking for opportunities that may emerge from the changing global economic landscape.

Conclusion

The US-China tariff war has entered uncharted territory with tariffs reaching unprecedented levels of 145% from the U.S. and 125% from China. This economic confrontation has created significant volatility in traditional markets while testing the resilience of cryptocurrency markets.

Key takeaways from the current situation include:

- Stock markets have suffered substantial losses, with the S&P 500 losing $5.8 trillion in market value since the initial tariff announcements

- Bitcoin has demonstrated surprising resilience, maintaining support above $81,000 despite initial volatility

- Evidence suggests a potential decoupling between cryptocurrency and traditional markets during this economic stress test

- The tariff war may inadvertently benefit Bitcoin's network security by promoting a more globally distributed mining ecosystem

- Investors are increasingly considering cryptocurrencies as part of diversified strategies during periods of geopolitical tension

As the situation evolves, both cryptocurrency and traditional investors should maintain vigilance, prepare for continued volatility, and consider the long-term implications of what may be a fundamental shift in the global economic order.

Key Metrics to Monitor

- Bitcoin Support Levels: Watch $81,000 as critical floor

- Stock-Crypto Correlation: Continued divergence would strengthen decoupling thesis

- DeFi Activity: Indicator of trust in decentralized systems during economic uncertainty

- Mining Difficulty Adjustments: Reflect changes in global mining distribution

- Diplomatic Developments: Any signals of negotiation or further escalation

Comments

Post a Comment